Smarter, Safer, Sustainable Fleets

At Fuse Fleet, we deliver a comprehensive range of fleet services designed to redefine fleet management.

Our AI-powered data analytics uncover insights that reduce crash risks and improve driver performance. Our fleet insurance solutions reward safe driving with fair, transparent premiums, while risk management tools provide proactive strategies to prevent incidents and build a culture of safety.

Digital claims management streamlines processes, minimising downtime and administrative costs and ESG reporting empowers you to achieve sustainability goals and drive compliance.

Fuse Fleet provides businesses with AI-driven solutions to create safer, smarter and more sustainable operations. By combining data insights, tailored insurance, proactive risk management and ESG-focused strategies, we help fleets achieve operational excellence.

The Fuse Fleet team will work collaboratively with you to build a safer, smarter and more sustainable fleet. Explore our services to discover how we can transform your fleet management practices.

Fleet Insurance

Proactively manage risks, lower premiums, improve safety and optimise fleet operations.

Claims Management

Simplify claims with digital tools and expert support to reduce downtime and costs.

Risk Management

Encourage safer driving with AI tools, training and proactive fleet risk strategies.

Data Analytics

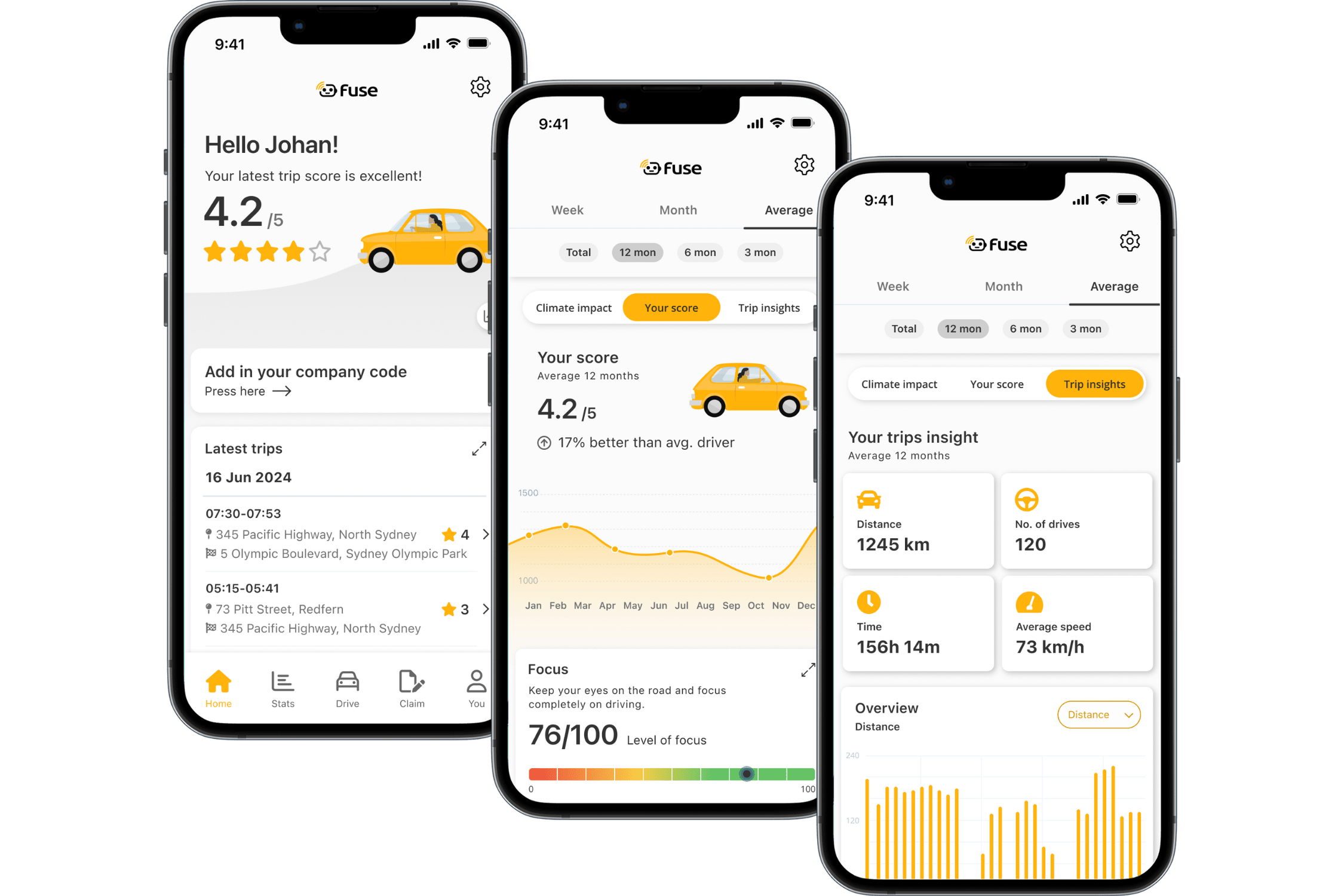

Turn GPS data into crash probability scores, enabling smarter decisions to improve fleet safety and efficiency.

ESG Reporting

Convert GPS data into ESG insights to cut emissions, boost safety and meet sustainability goals with ease.

Why Fuse Fleet?

At Fuse Fleet, we are your partner in delivering smarter insurance solutions that reward safe driving and aim to provide lower fleet insurance premiums. Our comprehensive range of AI-driven solutions complements our insurance solutions by offering data insights, proactive risk management strategies, streamlined claims handling and actionable ESG reporting.

Supported by the intuitive Fuse Fleet App, you’ll have the tools and expertise to enhance safety, optimise costs and achieve sustainability goals while keeping your fleet running at peak efficiency.